U.S. Alcohol Brands Disappear in Canada as Tariff Tensions Soar

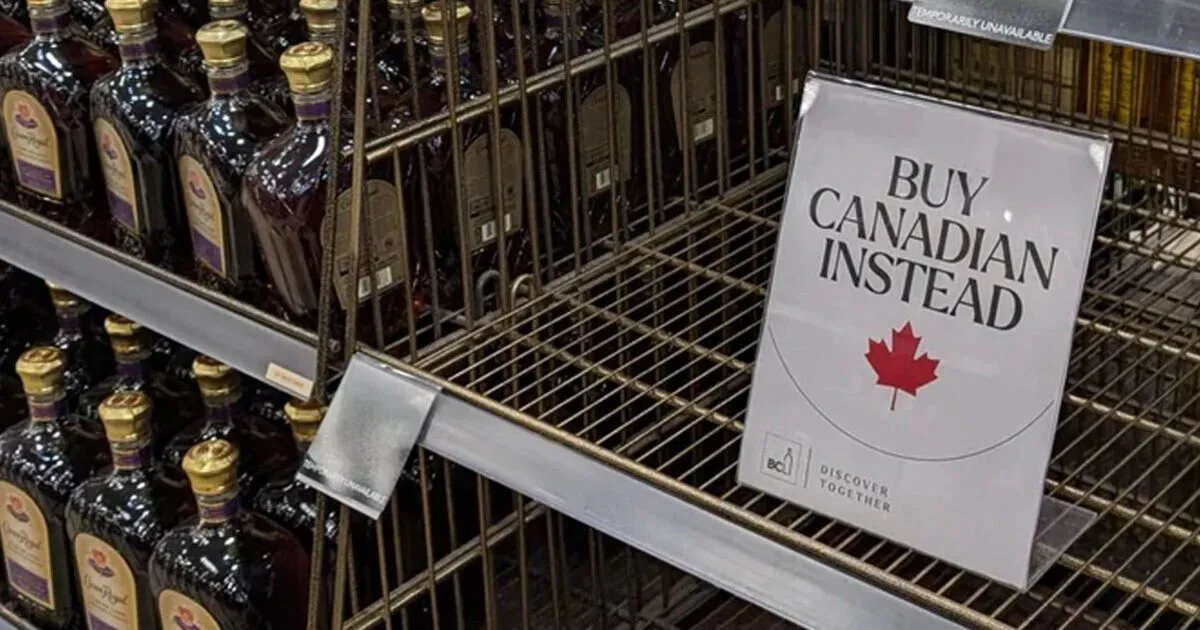

The U.S.-Canada trade war has taken a new turn, hitting liquor shelves hard. Iconic American brands like Jack Daniel’s, Bacardi Rum, and Jim Beam are disappearing from Canada’s retail stores as rising tariffs on U.S. alcohol imports drive up prices and limit supply. The fallout is already reshaping the Canadian spirits market, forcing consumers to reconsider their choices.

The Shrinking U.S. Presence in Canada

According to the Canadian Alcohol and Tobacco Control (ATC), U.S. spirits accounted for 25% of Canada’s alcohol sales before the tariffs. In just six months, that share has dropped by 9%, leaving shelves increasingly devoid of American whiskey, bourbon, and rum. The most impacted brands include:

- Jack Daniel’s Tennessee Whiskey

- Bacardi Rum

- Jim Beam Bourbon

- Wild Turkey

- Maker’s Mark

Key Statistics:

- 9% decline in U.S. alcohol market share in Canada.

- 4-8% increase in retail prices for U.S. spirits.

- 12% drop in U.S. alcohol exports to Canada in 2025.

Soaring Prices and Consumer Shift

With higher tariffs in place, the cost of U.S. spirits has surged. Price hikes range between 4% and 8%, making American liquors less competitive. For example:

- Jack Daniel’s Tennessee Whiskey: $35 → $38 (+8.57%)

- Bacardi Rum: $28 → $30.50 (+8.93%)

- Jim Beam Bourbon: $33 → $35 (+6.06%)

As a result, many Canadian consumers are now seeking domestic and international alternatives to replace their favorite U.S. brands.

Rise of Local and Global Spirits

With American brands becoming less accessible, Canadian whiskey and European imports are filling the gap. A survey by the Canadian Spirits Association found that:

- 62% of Canadians have switched to domestic brands like Canadian Club and Crown Royal.

- 23% are exploring European and Latin American imports such as Jameson, Havana Club, and Glenlivet.

- 15% have reduced their alcohol purchases altogether due to price hikes.

Impact on U.S. Liquor Industry

The trade dispute isn’t just affecting Canadian drinkers—it’s hitting U.S. alcohol producers hard. According to the Distilled Spirits Council of the United States (DISCUS), U.S. alcohol exports to Canada have declined by 12%, equating to a $360 million loss in revenue for American distillers in just one year.

U.S. Alcohol Exports to Canada:

- 2024: $3 billion

- 2025: $2.64 billion (-12%)

Interesting Read

What’s Next?

As trade negotiations remain uncertain, it’s unclear when—if ever—U.S. alcohol brands will regain their stronghold in the Canadian market. If tariffs persist, consumers may permanently shift to alternatives, causing long-term damage to U.S. liquor exports.

Key Takeaways:

- U.S. alcohol market share in Canada has dropped 9% in six months.

- Prices of American spirits have increased by 4-8%, leading to lower demand.

- 62% of Canadians are now choosing domestic alternatives.

- U.S. liquor exports to Canada have fallen by $360 million (12%) due to tariffs.

For now, Canadian consumers must navigate higher prices and limited choices, while U.S. liquor brands face an uphill battle to regain lost ground.